In the first half of 2025, China’s smart projector market bid farewell to its previous growth trajectory and entered a phase of phased adjustment. From the perspective of core data, the market showed a pattern of "declines in both sales volume and revenue", but it was also accompanied by new changes such as optimized price segment structure and accelerated technological upgrading, pointing out a transformation direction for the industry’s future development.

I. Core Market Data: Declines in Both Volume and Revenue, Entering an Adjustment Cycle

According to the latest industry statistics, the sales volume of China’s smart projector market in H1 2025 reached 2.778 million units, a year-on-year decrease of 3.9%; the sales revenue amounted to 4.68 billion yuan, a year-on-year decrease of 2.9%. This marks the first double-digit decline in the first half of the year in recent years, indicating that the industry has shifted from high-speed growth to a phase of structural adjustment. From the perspective of data differences, the decline in revenue was smaller than that in sales volume, reflecting a slight increase in the overall average unit price of the market and the initial supporting role of mid-to-high-end products in driving revenue.

Three Core Reasons for Market Contraction

- Weak Consumer Spending: Prominence of Non-Essential Attribute

Against the backdrop of tightened consumer budgets, smart projectors, as "non-rigid home entertainment devices", have become a priority for many consumers to cut expenses. Compared with daily necessities such as refrigerators and washing machines, their "replaceable" nature leads to greater demand elasticity, resulting in a significant weakening of consumer purchasing willingness in the first half of the year.

- Policy Impact: Absence of Subsidy Dividends

Smart projectors were not included in the "12+3" core subsidized categories launched by the state in 2025, while traditional home appliances such as TVs and air conditioners enjoyed direct policy dividends. This discrepancy deprived smart projectors of policy-driven consumer stimulus, further weakening their market competitiveness compared with subsidized home appliance products.

- Competition from Substitutes: Intensified Multi-Dimensional Competition

On one hand, the price of 75-inch large-screen TVs has continued to drop to around 2,500 yuan and has been included in the subsidy scope. Relying on "higher picture quality stability + policy preferences", they have diverted a large amount of home large-screen demand. On the other hand, the portability and versatility of mobile phones and tablets have further squeezed the market space of smart projectors in "light entertainment scenarios", especially exerting a significant impact on entry-level portable projectors.

II. Market Structure Changes: Shrinkage of Low-End Segment, Mid-to-High-End Becoming the New Mainstream

In H1 2025, the price segment structure of China’s smart projector market showed a prominent feature of "shrinkage of low-end segment and stability of mid-end segment", marking the market’s transformation from "low-price volume-driven" to "quality consumption".

- Low-End Market (Below 500 Yuan): Significant Share Shrinkage

The sales share of products in this price segment dropped from 33.2% in the same period of 2024 to 22.1%, a decrease of more than 11 percentage points. Low-end products, characterized by poor picture quality and single functions, were the first to be affected during the period of weak consumption. Some small and medium-sized brands have gradually withdrawn from the market due to meager profits and lack of competitiveness.

- Mid-End Market (500-999 Yuan): Becoming the Largest Segmented Track

With "balanced cost-effectiveness", this price segment has become the first choice for consumers, accounting for 32.8% of total sales in the first half of the year and firmly ranking first among all price segments. Products in this range mostly have basic smart functions (such as auto-focus and voice control) and acceptable picture quality, which not only meet the core needs of the general public but also avoid the experience shortcomings of low-end products, serving as a "stabilizer" for the market.

- Brand Competition: Increased Concentration, Accelerated Exit of Small and Medium-Sized Brands

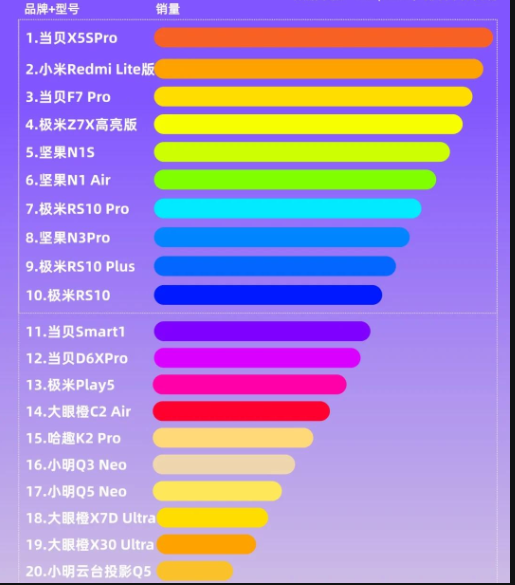

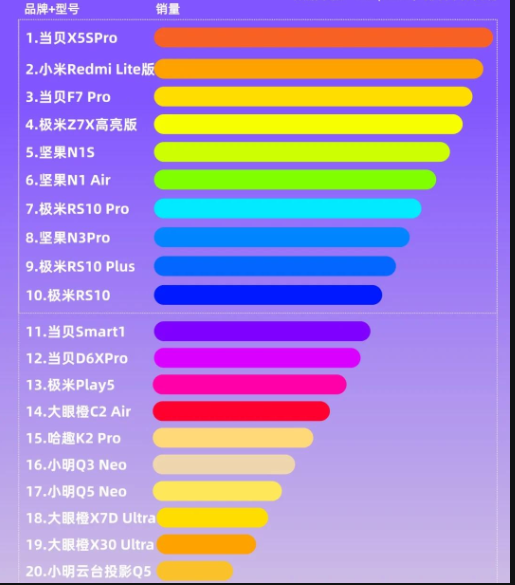

Amid market contraction, consumers are more inclined to choose leading brands with good reputation and excellent quality control, further compressing the living space of small and medium-sized brands. Relying on technological accumulation and supply chain advantages, leading brands have consolidated their market positions through product iteration and service upgrading. The industry’s CR5 (concentration ratio of top 5 brands) increased by 8 percentage points compared with the same period last year, and the trend of market concentration towards leading enterprises has become increasingly obvious.

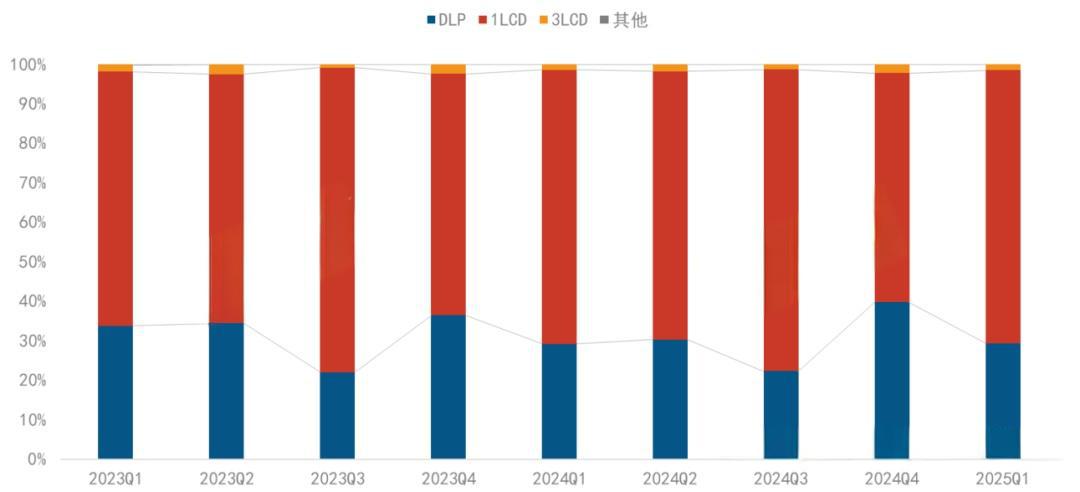

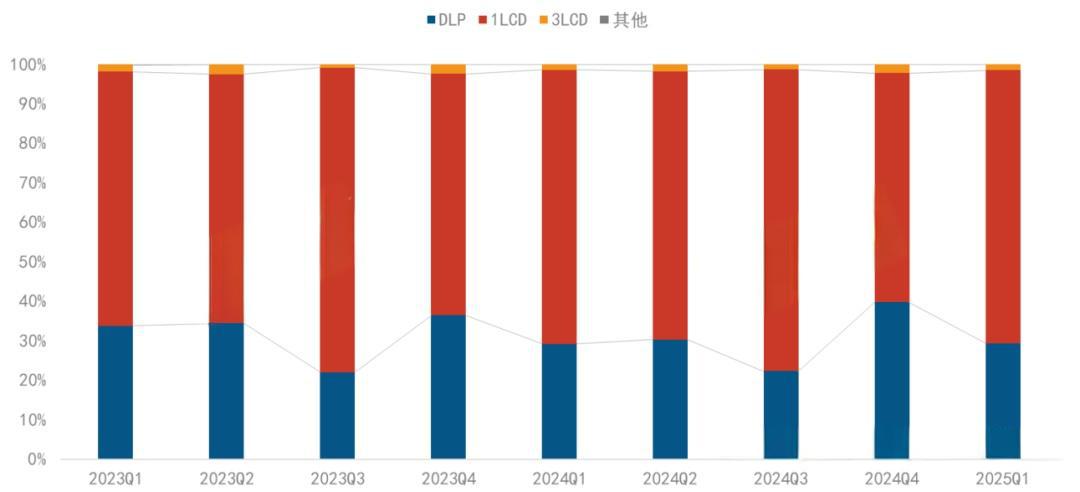

III. Performance of Technical Routes: Decline in All Three Mainstream Technologies, Stable Structural Pattern

In H1 2025, sales of the three mainstream projection technologies (DLP, 1LCD, and 3LCD) all declined to varying degrees, but the market share structure remained basically stable, and the advantages of leading brands in each technical route were further strengthened.

1. DLP Technology: Intensified Monopoly by Leading Brands, Slight Share Decline

DLP technology accounted for 30.8% of the online market share, with sales volume decreasing by 5% year-on-year. Despite the overall sales decline, the concentration of leading brands was extremely high: the combined share of four major brands (Xgimi, JMGO, Dangbei, and Vidda) exceeded 94%, almost monopolizing this technical track. Relying on the advantages of "high contrast + miniaturization", DLP technology still dominates the mid-to-high-end home theater scenario, and 4K resolution products have become the main growth driver of this technical route.

2. 1LCD Technology: Maintaining the First Place in Share, Increased Concentration

1LCD technology maintained the top position in the online market with a 67.8% share, but its sales volume decreased by 9.4% year-on-year, mainly affected by the shrinking demand for low-end products. In terms of market structure, brands such as Xiaomi and Oshine have continued to rise in sales rankings relying on supply chain integration capabilities and cost-effectiveness advantages. The industry’s CR3 (concentration ratio of top 3 brands) increased to 65%, and the market gap left by the exit of small and medium-sized brands was quickly filled by leading enterprises.

3. 3LCD Technology: Stable Share, New Products Driving Demand

3LCD technology maintained an online market share of 1.5%. Although its share is not high, it has significant technical advantages (high color reproduction). In April 2025, Epson launched the "Tri-Core Three-Color Full-Color Engine" technology and simultaneously released the entry-level 4K new product EF-51. With "high color performance + affordable price", it has attracted professional users and driven the demand recovery of 3LCD technology to a certain extent.

4. Emerging Technologies: 2LCD and Micro LED Making Their Mark

- 2LCD Technology: The 2LCD new product NPX955, manufactured by Kejinming and branded under Philips, is priced at approximately 3,500 yuan. With the selling points of "dual LCD panels + high brightness", it targets mid-end business and home scenarios, providing a new technical option for the market.

- Micro LED Technology: Digital Light Core exhibited a 4K Micro LED projector prototype at the 2025 SID Exhibition in the United States. It adopts three 0.69-inch self-illuminating light cores, each with a 4K resolution and a pixel size of only 4 microns. Relying on the characteristics of "ultra-high brightness + long lifespan", it demonstrates the technical potential of the high-end projector market and provides a direction for the industry’s future technological upgrading.

IV. Product Upgrade Direction: Four Technologies Leading Mid-to-High-End Transformation

Despite the overall market contraction, the pace of technological upgrading for mid-to-high-end products has not slowed down. The penetration of four key technologies (laser, 4K, optical zoom, and AI) has not only increased product added value but also alleviated the pressure of revenue decline to a certain extent, becoming the core driving force for the industry’s transformation.

- 4K Resolution: Sales Growth Exceeding 50%

In H1 2025, the sales share of 4K smart projectors reached 11.1%, with a year-on-year growth of over 50%. With the maturity of technology, the prices of 4K products across different technical routes (DLP and 1LCD) have declined, and some entry-level 4K models have dropped below 3,000 yuan, promoting the transition of 4K resolution from "high-end exclusive" to "mid-end popularization".

- Laser Light Source: Share Exceeding 14%, Three-Color Laser Becoming Standard

The sales share of laser light source products reached 14.3%, a year-on-year growth of 17%, among which three-color laser accounted for more than 80%, having become the "standard configuration" for mid-to-high-end new products. Relying on the advantages of "high brightness, low attenuation, and wide color gamut", laser technology has continued to see growing demand in scenarios such as home theaters and business meetings, gradually replacing traditional LED light sources.

- Optical Zoom: Revenue Contribution Exceeding 23%

Optical zoom products accounted for 6.2% of sales volume but 23.4% of sales revenue, highlighting their characteristics of "high unit price and high added value". The optical zoom function can flexibly adjust the screen size without losing picture quality, making it favored by mid-to-high-end home users and business users, and has become a key selling point for product differentiated competition.

- AI Technology: Accelerated Penetration of Far-Field Voice and Large Models

Products equipped with far-field voice functions accounted for 7.3% of sales volume, while products supporting AI large models accounted for 6.6%. The application of AI technology has upgraded smart projectors from "display devices" to "smart interactive hubs", allowing users to realize functions such as content search, device control, and scenario linkage through voice, further enhancing the user experience.

V. Full-Year Outlook: Market Remaining in Adjustment Period, Seeking Breakthroughs in Three Directions

It is expected that throughout 2025, the sales volume of China’s smart projector market will reach 5.728 million units, a year-on-year decrease of 5.2%; the sales revenue is expected to be 9.54 billion yuan, a year-on-year decrease of 4.6%, and the market will remain in an adjustment cycle. The future growth of the industry needs to rely on breakthroughs in three directions:

- Overseas Markets: Exploring Incremental Space

Faced with the saturation of the domestic market, leading brands have accelerated their layout in overseas markets such as Southeast Asia and Europe. Relying on "high cost-effectiveness + localized content adaptation", they are seeking a new growth curve.

- Commercial Scenarios: Tapping B-End Demand

Commercial scenarios such as education, office, and cultural tourism have strong demand for projectors with high brightness and stability. Leading brands can expand their B-end market share through customized solutions (such as education-specific projectors and cultural tourism immersive projectors).

- In-Vehicle Projection: Exploring Emerging Scenarios

As a "new carrier for mobile entertainment", in-vehicle projection has become the focus of the industry. Some brands have begun to develop portable projection products adapted to in-vehicle scenarios, which are expected to become a new growth driver in the future.

Overall, although China’s smart projector market in H1 2025 faces short-term contraction pressure, the optimization of market structure and the acceleration of technological upgrading are laying the foundation for the long-term healthy development of the industry. In the future, only brands that focus on mid-to-high-end transformation, technological innovation, and scenario expansion can seize opportunities amid market adjustments and achieve sustainable growth.