According to the latest market data from Counterpoint, the global VR/AR market showed a "divergent" trend in 2024: VR headset shipments declined for the third consecutive year, with weak consumer demand and technical bottlenecks continuing to suppress the market; while the AR sector faced overall pressure, the integration of AI technology and growth in specific niche categories injected new vitality into the industry. The report also points out that enterprise market demand and "AR+AI" collaborative innovation will be the key forces driving breakthroughs in immersive technology.

In 2024, global VR headset shipments fell by 12% year-on-year, marking the third consecutive year of decline for the VR market since 2022. Counterpoint analysis suggests that three core issues—sluggish consumer demand, limitations in hardware performance, and insufficient supply of high-quality content—are the main factors restricting market recovery. Ordinary users still perceive VR as merely an "entertainment tool," while shortcomings of existing devices in weight (most products exceed 500g), battery life (less than 3 hours of single use), and interactive experience, coupled with the lack of blockbuster content (no hit products following Beat Saber), have led to a sustained decline in users' willingness to pay.

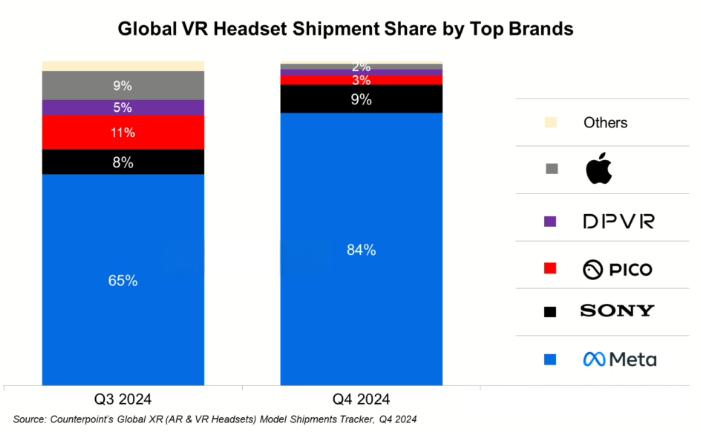

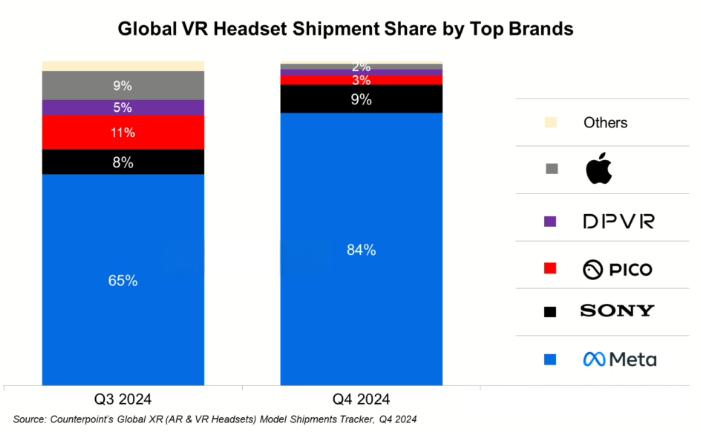

Despite the overall market pressure, the competitive landscape among leading manufacturers still showed distinct differences:

- Meta: Low-Price Strategy Consolidates Monopoly

Relying on its mature product ecosystem and price advantages, Meta maintained its top position with a 77% global shipment share in 2024. In the fourth quarter, it launched the more affordably priced Quest 3S (approximately 20% cheaper than the Quest 3), which accurately met the demands of the mid-to-low-end consumer market. Its market share for the single quarter further climbed to 84%, nearly monopolizing the mainstream consumer VR market. - Sony: Holiday Promotions Drive Short-Term Growth

Leveraging the PS5 console ecosystem, Sony's PlayStation VR2 adopted a "hardware price cut + game bundle" promotion strategy during the 2024 fourth-quarter holiday season, securing a 9% shipment share. It became the only consumer-facing manufacturer capable of competing with Meta, but its full-year performance remained constrained by the "single gaming scenario" limitation. - Apple: Slump in Consumer Segment, Seeking Breakthroughs in Enterprise Market

Apple's Vision Pro generated a buzz with the "spatial computing" concept when it launched in early 2024. However, as initial trial demand was exhausted, its performance in the consumer segment turned lackluster, with fourth-quarter shipments dropping 43% quarter-on-quarter. Nevertheless, the enterprise market emerged as an important growth driver—commercial versions of the Vision Pro tailored for healthcare, design, education, and training sectors achieved a quarter-on-quarter sales rebound by the end of the year, preserving Apple's development space in the VR field.

Unlike international manufacturers focusing on the consumer segment, Chinese VR manufacturers Pico and DPVR achieved differentiated breakthroughs by "shifting to the enterprise market":

- In 2024, Pico's shipments to enterprise clients exceeded consumer sales for the first time. Its "VR classroom solutions" customized for educational institutions and "immersive experience devices" built for offline cultural tourism became core growth drivers;

- By deepening its presence in the healthcare sector (e.g., VR devices for surgical simulation and rehabilitation training), DPVR achieved over 30% year-on-year growth in shipments in 2024, emerging as a representative Chinese manufacturer in the VR enterprise market.

Counterpoint points out that B-end demand in three sectors—education, healthcare, and offline entertainment—has become a "moat" for Chinese VR manufacturers to withstand the downturn in the consumer market.

Counterpoint predicts that the global VR market will still face growth headwinds from 2025 to 2026, with three core obstacles requiring urgent solutions:

- Shortage of Content Supply: Beyond gaming and audio-visual applications, high-quality VR applications in office, education, and healthcare scenarios remain scarce, and there is a lack of "killer apps" capable of appealing to mainstream users;

- Hardware Balance Dilemma: Existing VR headsets struggle to balance "lightweight design" and "high performance"—reducing weight leads to compromised battery life or display quality, while enhancing performance increases weight and costs. The issue of user comfort during long-term wear remains unresolved;

- Health and Experience Risks: Eye fatigue, dizziness caused by prolonged VR use, and potential impacts on children's vision development continue to be significant barriers to market popularization.

The report also emphasizes that despite these challenges, the technical potential of "spatial computing" remains promising. If future VR hardware can achieve "weight reduction to below 300g and battery life extension beyond 5 hours" while addressing content supply issues through AI-generated content (AIGC), the VR market is expected to reach a recovery inflection point.

Unlike the sustained downturn in the VR market, the global AR smart glasses market in 2024 exhibited a pattern of "overall decline with niche growth": full-year shipments fell 8% year-on-year, but products based on different technical paths showed distinct performance differences.

- Birdbath Technology Products: Steady Growth

AR glasses for video viewing based on Birdbath technology (focused on lightweight design, low prices, and mainly used for audio-visual entertainment and navigation) achieved 27% year-on-year growth in shipments in 2024. Relying on the "hundred-yuan price range" and "portable experience," they remained dominant in the AR market and became the mainstream choice for consumer AR products. - Waveguide Technology Products: Weak Demand

High-end AR glasses adopting waveguide technology (such as INMO series) saw a sharp 67% year-on-year drop in shipments in 2024 due to "high prices (most exceeding 3,000 yuan) and limited application scenarios." Counterpoint analysis suggests that while waveguide technology has advantages in "display clarity," consumer demand for its "AR interactive functions" has not yet materialized, leading to low market acceptance.

Despite short-term pressures, Counterpoint holds an optimistic long-term outlook for AR glasses, predicting that their shipments will achieve an average annual growth of over 30% by 2026. The core driver lies in the deep integration of AI technology and AR:

- Generative AI Reinvents the Experience: With the maturity of generative AI technologies such as ChatGPT and ERNIE Bot, AR glasses are evolving from "display tools" to "AI interactive terminals." Users can use voice commands to make AR glasses generate real-time navigation routes, translate text, and analyze scene information, significantly expanding usage scenarios;

- Breakthroughs in Operating Systems and Ecosystems: Google's planned Android XR operating system will integrate its powerful AI models (e.g., Gemini) with the Android app ecosystem, providing a unified platform for AR software development. This will address the current "fragmentation" of AR applications and is expected to spawn more innovative use cases;

- Deepening Industry Scenarios: In industries such as manufacturing and logistics, "AR+AI" has begun to be implemented—workers wearing AR glasses can receive real-time AI-driven equipment fault diagnosis results, and logistics staff can quickly identify package information via AR glasses. B-end demand in these scenarios will become an important pillar of AR market growth.

Overall, the global immersive technology market in 2024 presented a pattern of "VR in the doldrums, AR seeking opportunities": the VR market will continue to face challenges in the short term due to weak consumer demand and technical bottlenecks, but the recovery of the enterprise market provides a transitional space for manufacturers; while the AR market experienced an overall decline, it found a clear growth direction driven by AI technology.

Counterpoint analysis points out that the next wave of immersive technology will depend on three key actions:

- Expanding Application Scenarios: Shifting from "entertainment-centric" to "full-scenario coverage," especially deep penetration in B-end sectors such as manufacturing, healthcare, and education;

- Optimizing Hardware Design: VR needs to overcome the "weight-performance balance" dilemma, while AR needs to reduce the cost of waveguide technology products to improve public acceptance;

- Accelerating AI-XR Integration: Using AI to address core issues such as content supply, interactive experience, and scenario adaptation, and unleashing the synergistic value of "AR+AI."

In the future, with the continuous release of enterprise demand and the growing maturity of "AR+AI" technology, the global immersive technology market is expected to gradually emerge from its slump and embark on a new growth cycle.